Fulton Bank decreased its stake in Microsoft Corp (MSFT) by 2.34% based on its latest 2018Q3 regulatory filing with the SEC. Fulton Bank sold 3,502 shares as the company’s stock declined 1.64% with the market. The institutional investor held 146,135 shares of the prepackaged software company at the end of 2018Q3, valued at $16.71M, down from 149,637 at the end of the previous reported quarter. Fulton Bank who had been investing in Microsoft Corp for a number of months, seems to be less bullish one the $782.57 billion market cap company. The stock increased 4.65% or $4.53 during the last trading session, reaching $101.93. About 44.06M shares traded or 5.32% up from the average. Microsoft Corporation (NASDAQ:MSFT) has risen 30.43% since January 6, 2018 and is uptrending. It has outperformed by 30.43% the S&P500. Some Historical MSFT News: 11/04/2018 – Commvault Expands Microsoft Azure Stack Integration; 13/03/2018 – Telecom Paper: Microsoft to open two cloud centres in Germany – report; 17/04/2018 – Conduent Wins Contract to Deliver Comprehensive Transportation Ticketing System in Northern Italy; 29/03/2018 – MICROSOFT MSFT.O SAYS TO INVEST $30 MLN IN FRANCE OVER 3 YEARS TO HELP DEVELOP ARTIFICIAL INTELLIGENCE (Al) SECTOR IN FRANCE; 17/04/2018 – RedLock Enhances Visibility, Compliance Assurance, and Threat Detection Capabilities With Microsoft Azure; 25/04/2018 – Zerto Announces Cross-Selling Agreement with Microsoft to Deliver Advanced Multi-Cloud Resilience and Application Mobility Capa; 16/05/2018 – Businesses still use email but are moving toward clients like Slack, Microsoft Teams and Google Hangouts; 07/05/2018 – Bitcoin and other cryptocurrencies are “kind of a pure ‘greater fool theory’ type of investment,” Microsoft co-founder Bill Gates said Monday on CNBC’s “Squawk Box.”; 05/03/2018 – eXp Realty Hires Stacey Onnen as Senior Vice President of Brokerage Operations; 15/05/2018 – Uber, Lyft scrap mandatory arbitration for sexual assault claims

Baldwin Investment Management Llc decreased its stake in Amazon.Com Inc (AMZN) by 8.37% based on its latest 2018Q3 regulatory filing with the SEC. Baldwin Investment Management Llc sold 170 shares as the company’s stock declined 15.37% with the market. The institutional investor held 1,860 shares of the consumer services company at the end of 2018Q3, valued at $3.73M, down from 2,030 at the end of the previous reported quarter. Baldwin Investment Management Llc who had been investing in Amazon.Com Inc for a number of months, seems to be less bullish one the $770.32 billion market cap company. The stock increased 5.01% or $75.11 during the last trading session, reaching $1575.39. About 9.18M shares traded or 20.30% up from the average. Amazon.com, Inc. (NASDAQ:AMZN) has risen 41.49% since January 6, 2018 and is uptrending. It has outperformed by 41.49% the S&P500. Some Historical AMZN News: 01/05/2018 – Computer Design & Integration LLC (CDI LLC) Achieves Amazon Web Services (AWS) Service Catalog Accreditation; 17/04/2018 – Robots will replace humans in retail, says China’s JD.com; 02/04/2018 – Nike tops Wall Street expectations; confirms deal with Amazon; 06/04/2018 – EXCLUSIVE- Mnuchin to CNBC: Amazon’s practice of not collecting taxes from third-party sellers ‘doesn’t make sense’; 30/05/2018 – Applause Launches lndustry’s First Crowdtesting Offering for Amazon Alexa; 13/04/2018 – Amazon’s HQ2 team was in Newark, N.J. this week; 04/04/2018 – Striim Delivers Real-Time Data Integration for Apache Kudu; Enhances Interoperability with Azure HDInsight and Amazon Redshift; 30/04/2018 – Chico’s, Joining Nike and Sears, Turns to Amazon to Sell Its Products; 28/03/2018 – Miscommunications at Work Impact the Bottom Line, Study Finds; 26/04/2018 – Amazon now has a multibillion-dollar advertising business

Since August 31, 2018, it had 0 buys, and 10 insider sales for $54.07 million activity. Shares for $21.70 million were sold by Nadella Satya. Capossela Christopher C had sold 4,000 shares worth $432,000. Hogan Kathleen T had sold 40,000 shares worth $4.45 million on Friday, August 31. $2.15M worth of Microsoft Corporation (NASDAQ:MSFT) shares were sold by BROD FRANK H.

Fulton Bank, which manages about $1.52 billion US Long portfolio, upped its stake in Visa Inc (NYSE:V) by 2,361 shares to 48,631 shares, valued at $7.30M in 2018Q3, according to the filing. It also increased its holding in Pfizer Inc (NYSE:PFE) by 12,439 shares in the quarter, for a total of 93,013 shares, and has risen its stake in Bp Plc (NYSE:BP).

More notable recent Microsoft Corporation (NASDAQ:MSFT) news were published by: Nasdaq.com which released: “Technology Sector Update for 01/02/2019: SFET, GOOG, GOOGL, BIDU, MSFT, AAPL, IBM, CSCO – Nasdaq” on January 02, 2019, also Nasdaq.com with their article: “Technology Sector Update for 12/18/2018: MRIN, GOOGL, DPW, ORCL, MSFT, IBM, AAPL, CSCO, GOOG – Nasdaq” published on December 18, 2018, Seekingalpha.com published: “Microsoft: It’s Not All That Rosy – Seeking Alpha” on December 13, 2018. More interesting news about Microsoft Corporation (NASDAQ:MSFT) were released by: Nasdaq.com and their article: “After Hours Most Active for Dec 31, 2018 : FRC, T, QQQ, MSFT, PFE, SNV, D, GOV, CPB, CSCO, AAPL, MDLZ – Nasdaq” published on December 31, 2018 as well as Nasdaq.com‘s news article titled: “Microsoft Becomes Oversold – Nasdaq” with publication date: December 24, 2018.

Analysts await Microsoft Corporation (NASDAQ:MSFT) to report earnings on January, 30. They expect $1.09 earnings per share, up 13.54% or $0.13 from last year’s $0.96 per share. MSFT’s profit will be $8.37B for 23.38 P/E if the $1.09 EPS becomes a reality. After $1.14 actual earnings per share reported by Microsoft Corporation for the previous quarter, Wall Street now forecasts -4.39% negative EPS growth.

Investors sentiment decreased to 0.81 in 2018 Q3. Its down 0.03, from 0.84 in 2018Q2. It worsened, as 33 investors sold MSFT shares while 981 reduced holdings. 145 funds opened positions while 681 raised stakes. 5.28 billion shares or 0.60% less from 5.31 billion shares in 2018Q2 were reported. White Pine Invest accumulated 4.23% or 77,201 shares. Moreover, Gillespie Robinson & Grimm has 0.14% invested in Microsoft Corporation (NASDAQ:MSFT) for 9,955 shares. Capital World stated it has 5.16% of its portfolio in Microsoft Corporation (NASDAQ:MSFT). Steadfast Capital Mgmt Lp reported 4.38% stake. Lsv Asset holds 198,745 shares or 0.03% of its portfolio. Bb&T Secs Lc accumulated 1.15 million shares. Mrj Inc has 54,091 shares for 3.38% of their portfolio. Rwc Asset Llp reported 1.51% stake. Arvest National Bank Trust Division owns 11,065 shares. Raymond James & stated it has 8.88 million shares or 1.57% of all its holdings. Town Country Natl Bank Trust Company Dba First Bankers Trust Company has 3.57% invested in Microsoft Corporation (NASDAQ:MSFT). Drexel Morgan owns 2.54% invested in Microsoft Corporation (NASDAQ:MSFT) for 25,198 shares. White Pine Ltd Limited Liability Company holds 52,252 shares. Royal Bank Of Canada reported 1.26% in Microsoft Corporation (NASDAQ:MSFT). Grassi Invest Mngmt stated it has 164,394 shares or 2.78% of all its holdings.

Among 38 analysts covering Microsoft Corporation (NASDAQ:MSFT), 34 have Buy rating, 1 Sell and 3 Hold. Therefore 89% are positive. Microsoft Corporation had 216 analyst reports since July 22, 2015 according to SRatingsIntel. Wunderlich upgraded Microsoft Corporation (NASDAQ:MSFT) on Friday, October 21 to “Buy” rating. The stock of Microsoft Corporation (NASDAQ:MSFT) earned “Buy” rating by Bernstein on Monday, June 11. The stock of Microsoft Corporation (NASDAQ:MSFT) has “Hold” rating given on Thursday, June 1 by Canaccord Genuity. Raymond James upgraded the stock to “Strong Buy” rating in Monday, November 30 report. Oppenheimer maintained Microsoft Corporation (NASDAQ:MSFT) on Tuesday, October 31 with “Outperform” rating. Jefferies maintained it with “Sell” rating and $49.0 target in Tuesday, August 22 report. The company was maintained on Wednesday, January 3 by Piper Jaffray. The stock of Microsoft Corporation (NASDAQ:MSFT) earned “Outperform” rating by Credit Suisse on Monday, July 17. The rating was maintained by Wells Fargo on Thursday, April 12 with “Buy”. Bernstein maintained the shares of MSFT in report on Wednesday, November 15 with “Buy” rating.

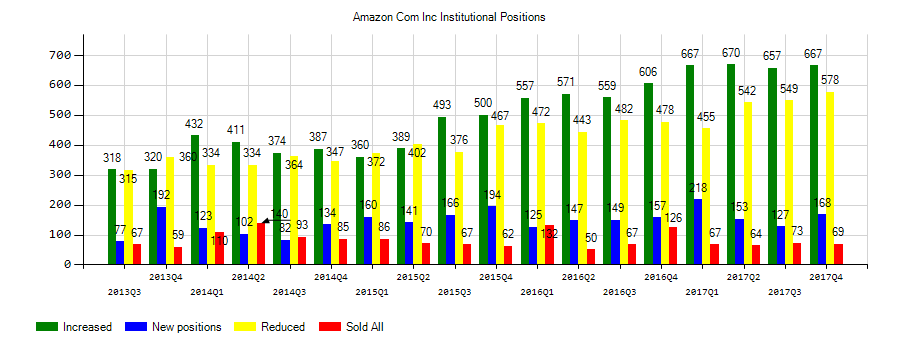

Investors sentiment decreased to 1.18 in 2018 Q3. Its down 0.16, from 1.34 in 2018Q2. It worsened, as 55 investors sold AMZN shares while 636 reduced holdings. 157 funds opened positions while 655 raised stakes. 260.67 million shares or 2.89% less from 268.42 million shares in 2018Q2 were reported. Moreover, State Farm Mutual Automobile Ins has 0.06% invested in Amazon.com, Inc. (NASDAQ:AMZN). Proshare Advsrs Limited Liability Com owns 3.82% invested in Amazon.com, Inc. (NASDAQ:AMZN) for 280,668 shares. Insight 2811 Inc holds 0.14% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN) for 100 shares. Goodman Fincl, Texas-based fund reported 5,154 shares. 68,187 were reported by Cibc Asset Inc. Spears Abacus Advsrs Ltd owns 140 shares or 0.03% of their US portfolio. Vanguard Group Inc holds 2.32% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN) for 29.60 million shares. Greatmark Partners holds 0.22% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN) for 341 shares. 17,444 were accumulated by Utd Cap Advisers Limited Liability. Intl Gp reported 162,877 shares. Moody State Bank Trust Division holds 1.55% in Amazon.com, Inc. (NASDAQ:AMZN) or 30,444 shares. Hodges Capital Management Inc holds 0.04% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN) for 292 shares. Blue Chip reported 478 shares. 3,136 are held by Next Century Growth Invsts Limited Com. Moreover, Thompson Siegel Walmsley Ltd Llc has 0.01% invested in Amazon.com, Inc. (NASDAQ:AMZN) for 259 shares.

Among 56 analysts covering Amazon.com (NASDAQ:AMZN), 53 have Buy rating, 0 Sell and 3 Hold. Therefore 95% are positive. Amazon.com had 330 analyst reports since July 21, 2015 according to SRatingsIntel. The stock of Amazon.com, Inc. (NASDAQ:AMZN) has “Buy” rating given on Tuesday, February 13 by Macquarie Research. The stock has “Overweight” rating by Barclays Capital on Friday, July 13. The stock of Amazon.com, Inc. (NASDAQ:AMZN) has “Buy” rating given on Monday, August 7 by Tigress Financial. Piper Jaffray maintained Amazon.com, Inc. (NASDAQ:AMZN) on Friday, April 27 with “Buy” rating. As per Wednesday, September 27, the company rating was maintained by Needham. As per Monday, October 16, the company rating was maintained by Loop Capital Markets. The stock of Amazon.com, Inc. (NASDAQ:AMZN) has “Buy” rating given on Friday, April 27 by UBS. On Friday, July 27 the stock rating was maintained by JMP Securities with “Market Outperform”. Morgan Stanley maintained the stock with “Overweight” rating in Thursday, April 19 report. The firm has “Hold” rating given on Thursday, June 15 by KeyBanc Capital Markets.

Since August 15, 2018, it had 0 buys, and 22 sales for $92.11 million activity. 2,028 shares were sold by Olsavsky Brian T, worth $3.87M. 437 Amazon.com, Inc. (NASDAQ:AMZN) shares with value of $687,447 were sold by Reynolds Shelley. Shares for $285,960 were sold by Huttenlocher Daniel P on Thursday, November 15. 2,054 shares were sold by Blackburn Jeffrey M, worth $3.90M. BEZOS JEFFREY P had sold 16,964 shares worth $27.69M. Jassy Andrew R sold $3.28M worth of stock or 1,726 shares.

Analysts await Amazon.com, Inc. (NASDAQ:AMZN) to report earnings on February, 7. They expect $5.48 EPS, up 153.70% or $3.32 from last year’s $2.16 per share. AMZN’s profit will be $2.68 billion for 71.87 P/E if the $5.48 EPS becomes a reality. After $5.75 actual EPS reported by Amazon.com, Inc. for the previous quarter, Wall Street now forecasts -4.70% negative EPS growth.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.

Bagikan Berita Ini

0 Response to "Baldwin Investment Management Has Trimmed Amazon.Com (AMZN) Holding by $340,510; Microsoft (MSFT) Holder Fulton Bank Has Trimmed Its Stake by $399,228 as Market Value Declined - The FinExaminer"

Post a Comment