Every investing sector has an elite few names that most analysts would consider “no-brainers.” For instance, with e-commerce’s influence rising daily, Amazon.com, Inc. (NASDAQ:AMZN) is an automatic buy despite its occasional fluctuations. In the same vein, I love Microsoft Corporation (NASDAQ:MSFT). The iconic consumer technology firm has too many tailwinds to ignore, which should serve Microsoft stock quite well.

Of course, whenever analysts discuss MSFT as a longer-term investment, they invariably discuss the company’s latest advancements and innovations. When current Microsoft CEO Satya Nadella took over the reins, he refocused the organization and critically, made it relevant. Gone was the reliance on physical, old tech products; in was the emphasis on cloud computing and trends such as software-as-a-service (SAAS). Our own Vince Martin neatly sums up the excitement at Microsoft:

“Azure has a huge runway in front of it. The shift from disc-based Office sales to cloud-based Office 365 should continue for years. Microsoft Dynamics, the company’s CRM alternative to the namesake software of Salesforce.com, Inc. (NYSE:CRM) is making progress as well, with 67% growth year over year in Q2, per the Q4 conference call. The bear argument I made previously — that revenue and earnings growth weren’t sustainable — seems fully disproved at this point.”

Moreover, management recently affirmed that they are deeply invested in advantaging tomorrow’s technologies. As my colleague Bret Kenwell reported, MSFT will eventually become an artificial intelligence company, while still competing in the cloud against the likes of Amazon and Alphabet Inc (NASDAQ:GOOG, NASDAQ:GOOGL). Such news is very much welcome to the Microsoft stock faithfuls, who have put up with a lot.

But the real reason I’m strongly bullish on MSFT is that the company still benefits from “old school” tech. In fact, old school might make a comeback!

Microsoft Stock Still Loves Its Meat and Potatoes

Invariably, many who have recently jumped onboard Microsoft stock are doing so because of the innovations that my colleagues Martin and Kenwell described. You won’t find a contrarian argument from me. Wall Street loves cloud computing’s growth stories, and therefore, MSFT shares keep steadily rising.

But another element exists, and that’s laptop and desktop PCs. Sure, most folks on the street deride them as yesteryear technology, and that description has an element of truth. Nevertheless, PCs represent the backbone, or the meat and potatoes of consumer technology. That of course suits Microsoft stock because the company’s Windows operating system dominates “regular” computing.

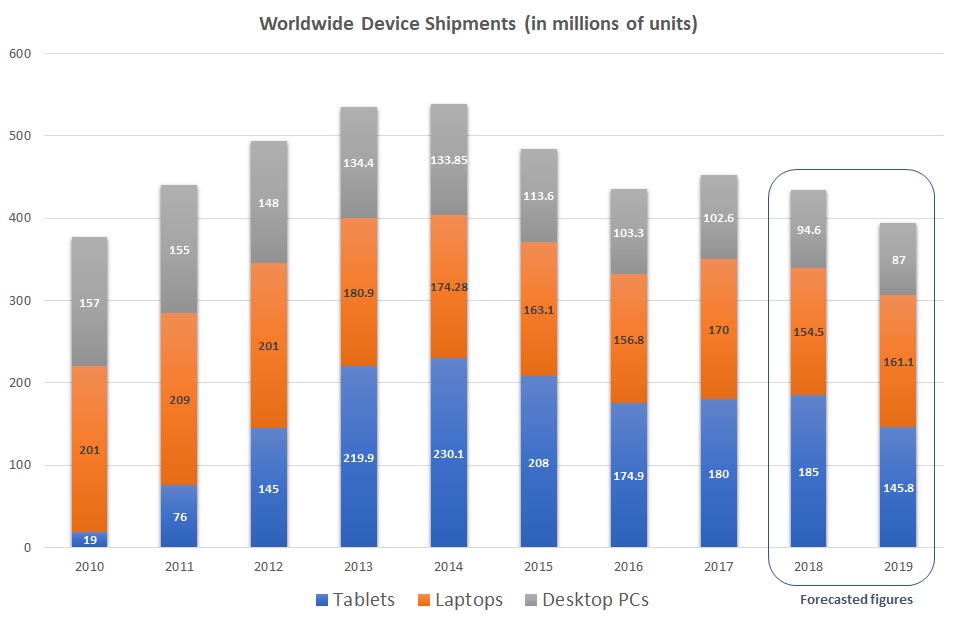

Investors, though, just haven’t realized this dominance because of Apple Inc.’s (NASDAQ:AAPL) trendy smart devices. Within a few years after the Apple iPad launched, the tablet format quickly took the majority of PC market share. Seemingly everyone was caught up in the tablet craze.

But when the euphoria died down, the tablet was exposed for what it truly is — a semi-useful gimmick. Perhaps it’s the preferred platform for slideshows, but when you want to do real work, you reach for a laptop. That’s why when I worked for Sony Corp (ADR) (NYSE:SNE), we all requested the latest Vaio laptop, not their tablet.

The retail market is definitely catching on. While tablet demand still dominates the broader PC landscape, its competitiveness is waning. According to industry experts, laptops will once again take majority market share in 2019. I honestly believe laptops will overtake tablets by the end of this year. If so, this will be great news for Microsoft stock.

Not only is MSFT relevant in the technologies everyone is chasing, the PC industry is slapping tablets upside the head. Microsoft just can’t lose!

A Possible Correction, and Then It’s Back to Business!

Having said that Microsoft stock is a no-brainer, one dynamic concerns me: the nearer-term picture. While perhaps most analysts have convinced themselves that the broader market correction is over, I’m not yet convinced. Should we see further weakness, I don’t think MSFT will hold up against the grain.

Therefore, I agree with Kenwell’s analysis that shares should be bought if it dips into mid-$80 territory. I would go so far as to say that any dip irrespective of its magnitude should be advantaged. Microsoft stock, as I affirmed earlier, is too strong of an investment to pass up.

Current investors are pinning their hopes on the company’s drive for innovation, and they likely won’t be denied. However, it’s the unlikeliest of catalysts — the PC market — that has me excited. With this formidable combo of old and new technologies, I don’t see any other direction for MSFT but up.

As of this writing, Josh Enomoto is long SNE.

https://investorplace.com/2018/02/microsoft-corporation-stock-will-benefit/Bagikan Berita Ini

0 Response to "Microsoft Corporation Stock Will Benefit From Resurgent PC Market"

Post a Comment